- Request a demo

- United States

.png)

Most insurance consumers start their journey by finding and comparing providers online, often through searches. Insurance purchases are highly personal and have many considerations — how much coverage do you want, are you adding family members to your plan, are you bundling multiple kinds of insurance? As with most complex, expensive, or personal purchases, insurance consumers will make a phone call during their journey.

To acquire more policyholders, insurance marketers are optimizing their channels to drive more high-quality calls. And, to increase phone conversions, they’re capturing conversation intelligence data and optimizing the contact center experience.

Read on to learn more about how insurance marketers are approaching 2023 and beyond.

1. 69% of insurance consumers ran a search before scheduling an appointment. For many insurance shoppers, search is the first step to assess their options. (Source: LSA)

2. Over 50% of insurance searches are performed on mobile devices. In our mobile-first world, many insurance searches are run on smartphones, which makes calling an agent more seamless than ever before. (Source: Blue Corona)

3. Mobile queries that contain “insurance near me” have grown by over 100% in the past two years. More than ever, insurance shoppers are placing local searches and researching agents in their area. (Source: Google)

4. 68% of insurance consumers did not have one company in mind when they started searching. This presents an opportunity to convert these undecided consumers with search ads. (Source: LSA)

5. $867 is the average amount insurance consumers spent after a search. Each undecided searcher is a major revenue opportunity — without a strong search marketing strategy, you’ll leave dollars on the table. (Source: LSA)

6. 38% of 10,000 surveyed US insurance policy holders were NOT taken out online, as of June of 2023. That means there’s potentially an opportunity to target a third of the nation who are either calling directly, going into an office in person, or using snail mail to meet their insurance needs. (Source: Statista.com)

7. 89% of customers are scouring the internet to find out what customers are saying before they commit to your service, so make sure your company's reputation is up to speed. Managing your online review is crucial so you put your best foot forward. (Source: sagefrog.com)

8. Insurance keywords are among the most expensive in Google Ads and Bing Ads and some can cost $50 or more per click. Insurance customers have high lifetime values and, as a result, paid search competition is fierce. (Source: WordStream)

9. The average conversion rate for an insurance search ad is 5.10%. For an insurance display network ad, it’s 1.19%. Despite the comparatively high cost of insurance ads, their conversion rates are consistent with most other industries. (Source: WebFX)

10. The US insurance industry is projected to spend over $15 Billion is digital ad spend in 2024. If you haven’t allocated a budget for advertising yet, you may want to start! (Source: insiderintellegence.com)

11. 78% of customers surveyed said they’re more likely to respond to personalized messages. Having enough first-party data to tailor your marketing is critical. (Source: Salesforce)

12. 78% of insurance consumers call a business after running a search. Since insurance is a complex purchase, the next step after a search is often a call to an agent to put together a plan. (Source: LSA)

13. 74% of consumers research insurance purchases online, but only 25% end up making a purchase online. Though most insurance consumers start their journey with a search, they prefer to speak to a live agent to make a purchase. (Source: J.D. Power)

14. Only 24% of small and medium businesses purchased their commercial insurance online. Businesses also prefer to speak to an agent to make insurance purchases. (Source: PwC)

15. Insurance shoppers are most likely to call during the purchase phase of their journey. Though calls are important throughout the multitouch insurance journey, they are most common when consumers are making a purchase. (Source: Google)

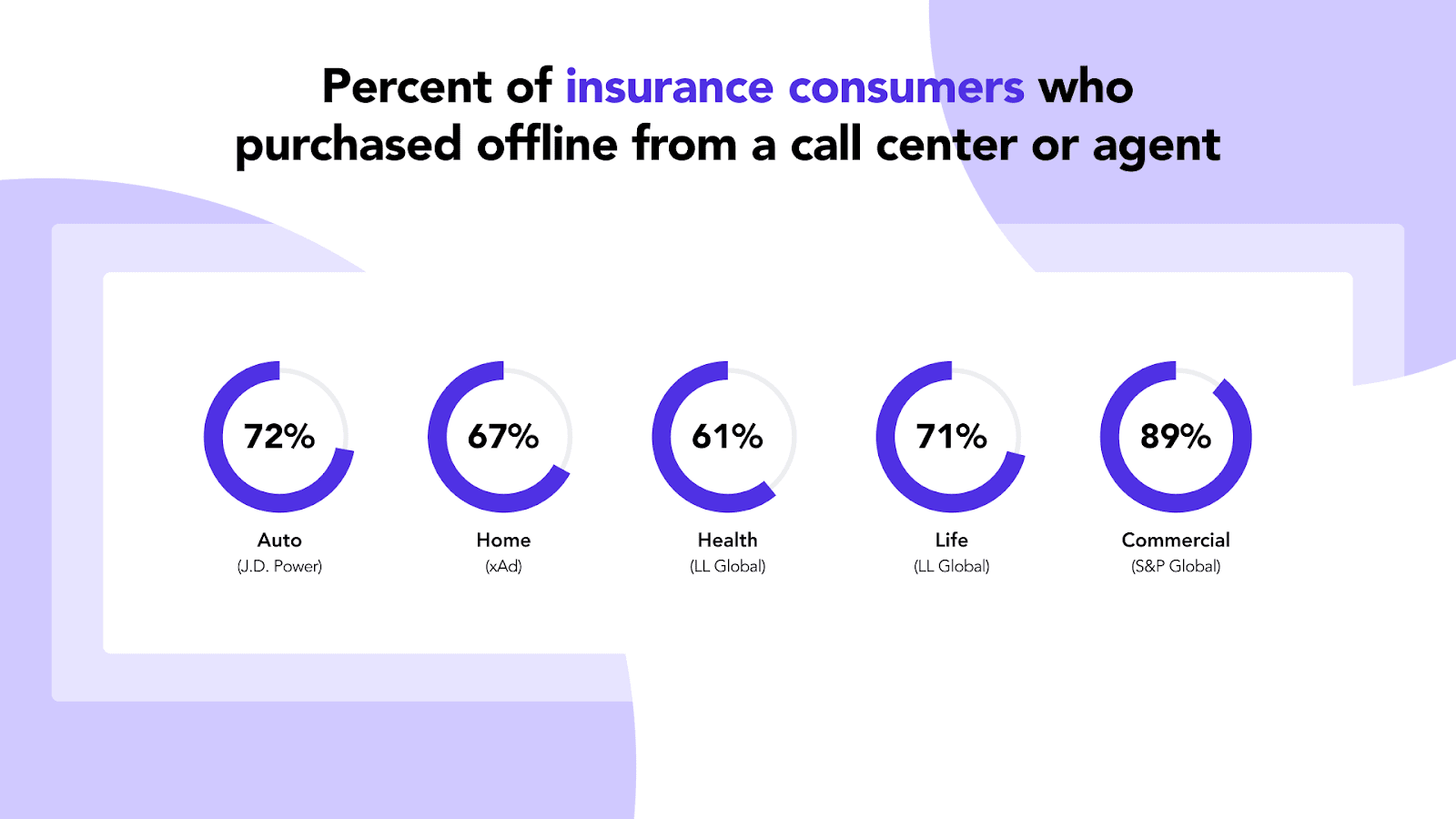

16. Auto insurance shoppers are the most likely to speak to an agent during their purchase journey, followed by home insurance, and health insurance consumers. The more complex the purchase, the more likely insurance consumers are to speak to a live agent. (Sources: J.D. Power, xAd, xAd, LL Global, S&P Global)

17. 62% of insurance buyers said talking with a rep on the phone was the most influential factor in their decision. Speaking with an agent is often the moment of truth for insurance purchases — delivering a seamless call experience is critical. (Source: xAd)

18. Almost 75% of customers who attempted to purchase insurance online reported problems. Though many insurance providers offer online purchase options, consumers often have difficulty navigating them and getting the help they need. (Source: Accenture)

19. The phone call is the preferred channel for insurance customers to convert. it ranks higher than online and in-person. (source: Invoca)

20. Calls will influence over $1 trillion in US consumer spending this year. In our mobile-first world, calls are often the most convenient way for customers to convert. (Source: BIA/Kelsey)

21. Phone calls convert to 10-15x more revenue than web leads. Calls are one of the most valuable conversions insurance marketers can drive. By tracking the calls driven by your insurance ads, you can measure your full ROI and optimize accordingly. (Source: BIA/Kelsey)

22. Callers convert 30% faster than web leads. Calls provide a more immediate return on your marketing investment. (Source: Forrester)

23. Caller retention rate is 28% higher than web lead retention rate. Driving calls from insurance marketing campaigns is also more profitable in the long-term — callers are more loyal than web leads. (Source: Forrester)

24. 84% of marketers report phone calls having higher conversion rates with larger order value (AOV) compared to other forms of engagement. Phone calls are often the most valuable conversions for insurance marketers. (source: Forrester)

25. 41% of organizations report having increased phone conversion rates by 25% or more in the past 12 months. Not only are consumers calling more due to COVID-19 — they’re also calling with higher intent to make a purchase. Both the volume and value of calls are increasing for many businesses due to COVID-19. (Source: Forrester)

26. 85% of marketers believe inbound calls and phone conversations are a key component of their organization’s digital-first strategy. Insurance marketers plan to tap into phone call data to better understand their customers and inform their strategies. (Source: Forrester)

27. 3 minutes and 24 seconds is the average time consumers wait on hold when calling insurance providers. Across the industry, consumers often have to wait to speak to a live agent and make a purchase. If you can lower this hold time, you’ll gain a competitive advantage. (Source: Talkdesk)

28. 1 minute and 30 seconds is the average wait time after which most callers will hang up. Many insurance callers have to wait longer than the average hang-up time to speak to a live agent. This results in lost sales and frustrated customers. (Source: AT&T)

29. 88% of insurance customers demand more personalization from providers. Expectations for the customer experience have never been higher — to acquire new customers, insurance marketers need to meet them. This includes delivering personalized call experiences. (Source: Accenture)

30. 21% of insurance customers say that providers do not tailor their customer experiences at all. Most insurance shoppers are failing to meet their consumers’ demands for personalization. (Source: Accenture)

31. In the past five years, US auto insurance carriers that have provided customers with consistently best-in-class experiences have generated two to four times more growth in new business and 30% higher profitability than firms with an inconsistent customer focus. There is a direct link between enhancing the customer experience and increasing profitability. (Source: McKinsey)

32. Satisfied customers are 80% more likely to renew their policies than unsatisfied customers. Enhancing the customer experience doesn’t only help with customer acquisition — it’s an effective customer retention strategy as well. (Source: McKinsey)

33. Less than one-third (29%) of insurance customers are satisfied with their current providers. Most insurance consumers are dissatisfied with their providers — often due to a poor customer experience. This puts them at risk of churning. (Source: Accenture)

34. 32% of consumers say phone calls are the most frustrating customer service channel. Simply fielding inbound phone calls isn’t enough for marketers — it’s important to have data on each caller so you can quickly and efficiently address their needs. (Source: Aspect)

35. 65% of consumers have cut ties with a brand over a single poor customer service experience. If you fail to provide seamless call experiences, it will cost you customers. (Source: Digiday)

36. 38% of consumers will stop doing business with a company if they have a bad call experience. Providing great call experiences is an exercise in customer retention. (source: Invoca)

37. Customer churn because of declining loyalty and poor customer experiences represents as much as $470 billion Life and Property & Casualty premiums globally. Insurance marketers are neglecting the customer experience and it’s having a direct impact on their revenue. (Source: Accenture)

38. Insurance prices have jumped 15% in 2023 and they’re projected to rise into 2024. Customers are going to be balancing saving money with getting coverage that makes them feel secure. If you can offer better value than your competitors, but your customer experience is off track, you risk them shopping elsewhere, and both you and your customer lose. (Source: thezebra.com)

39. 48% of marketers have provided or expect to provide enhanced customer experiences as a result of scaling conversation intelligence across the enterprise. With conversation intelligence data, insurance marketers can enhance ad targeting, segment email campaigns, serve personalized website experiences, and more, based on the content of phone conversations. (Source: Forrester)

40. 43% of marketers have improved or expect to improve customer acquisition and retention as a result of scaling conversation intelligence across the enterprise. When you tailor consumer experiences based on the content of their phone conversations, you better meet their needs and earn their loyalty. (Source: Forrester)

41. Marketers who have scaled conversation intelligence across the enterprise have seen or expect to see improved analytics efficiency, increased business efficiency, improved employee productivity, and seamless integration with existing systems. Conversation intelligence allows insurance companies to get smarter insights into their consumers and make more informed decisions to drive efficiency. (Source: Forrester)

It’s going to take more than the gimmicks of a lizard, an emu, or a screaming duck for insurance marketers to get the attention of new customers. Here are the insurance marketing trends that we expect to shape the insurance industry as we wrap up 2023 and head into 2024:

These trends reflect the ongoing digital transformation and evolving customer expectations in the insurance industry. Staying ahead of these developments and adapting marketing strategies accordingly will be crucial for insurers to remain competitive and effectively meet the needs of their target audiences.

Want to learn more about how Invoca can help your insurance marketing team drive more high-quality leads? Check out these resources: